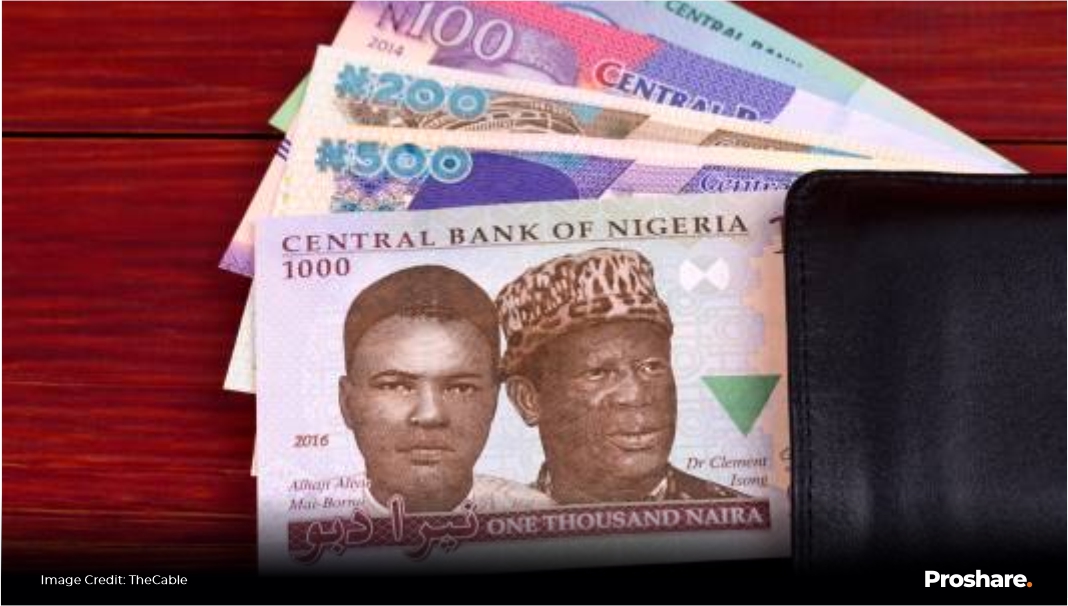

According to a Punch news report, Point-of-Sale (Pos) operators across the country under the umbrella of the Association of Mobile Money and Bank Agents of Nigeria (AMMBAN) have appealed to the President to prevail on the Central Bank of Nigeria (CBN) to review the current maximum cash withdrawal upward. The new policy by the CBN fixed weekly cash withdrawals for individuals at N100, 000 and for corporates at N500,000. The CBN also revised the maximum cash withdrawal via PoS terminals to N20,000 daily. The PoS operators in a petition dated 16 December 2022, called for the suspension of the policy to save 1.4m bank agents from losing their means of livelihood. National President of AMMBAN, Mr. Victor Olojo, who addressed journalists in Abuja, said over 1.4 million people will lose their jobs if the policy is not suspended or reviewed upward. The group specifically requested an upward review of the maximum withdrawal limit to N500, 000 weekly for individuals and N3m for corporates.

Elsewhere, Punch news reported that PoS operators in the nation are expecting their N700bn monthly revenue to fall by about 80% when the new CBN withdrawal limit kicks off. Since July, the monthly average revenue of PoS operators has stayed above N700bn according to data from the Nigeria Inter-Bank Settlement System. Revenue was N724.73bn in July; N711.17bn in August; N735.57bn in September; N753.6bn in October; and N759.29bn in November. Meanwhile, the Governor, Central Bank of Nigeria (CBN), Godwin Emefiele noted that the new cash withdrawal policy many be subject to review following necessary assessment.

We had noted in our previous daily that we expect the new threshold on cash withdrawals to impact small scale businesses, as availability of cash to run daily activities will be significantly reduced. We expect this to also impact the cost of doing business, albeit in the short term as a 10% levy has been imposed on huge cash withdrawals. In rural communities, where the availability of financial services is limited and many are not literate enough to move cash electronically, the policy may hinder their ability to conduct businesses seamlessly. Businesses and individuals will have to embrace the CBN cashless policy in the long run, but we also believe the CBN, and banks have a lot to do to improve the existing cashless economy infrastructure and provide solutions to the negative experiences people face when using electronic payments options.

That said, we note among other positive effects that stricter regulations around cash withdrawals will largely enhance a cashless economy by aggressively enforcing the adoption of electronic payment system. Again, it will reduce the amount of money in circulation outside the banking system, thereby enhancing the passthrough effects of monetary policies. The demand for dollars at the parallel market for speculative purposes and by individuals who would want to circumvent the impact of the Naira redesign will be largely reduced as the parallel market operators become wary of cash deposit charges. The new limits should also reduce the incidence of criminal cash ransom demands. Lastly, it will curtail money laundering, vote buying and incessant election spending particularly in the run-up to the February 2023 elections.

Lagos, NG • GMT +1

Lagos, NG • GMT +1

262 views

262 views

Sponsored Ad

Sponsored Ad

Advertise with Us

Advertise with Us